- May 9, 2025

Riding the Crypto Wave: Analyzing the 2025 Bull Market Drivers

- Luis Vargas

- Conscious Academy PR

Introduction

The cryptocurrency market entered 2025 with significant momentum, reigniting discussions about a potential sustained bull run. After navigating the turbulent waters of previous cycles, investors and analysts are closely monitoring various factors that could propel digital assets to new heights. Bitcoin, the market's bellwether, surpassed the landmark $100,000 threshold early in the year, fueled by unprecedented demand for newly approved spot Bitcoin Exchange-Traded Funds (ETFs) in the United States.1 While corrections and volatility remain inherent characteristics of the market, a confluence of institutional adoption, evolving regulatory landscapes, technological advancements, and macroeconomic shifts suggests that the foundations for a significant bull market in 2025 may be solidifying.2 This analysis delves into the key drivers shaping the current market dynamics and explores the potential trajectory for cryptocurrencies in the year ahead.

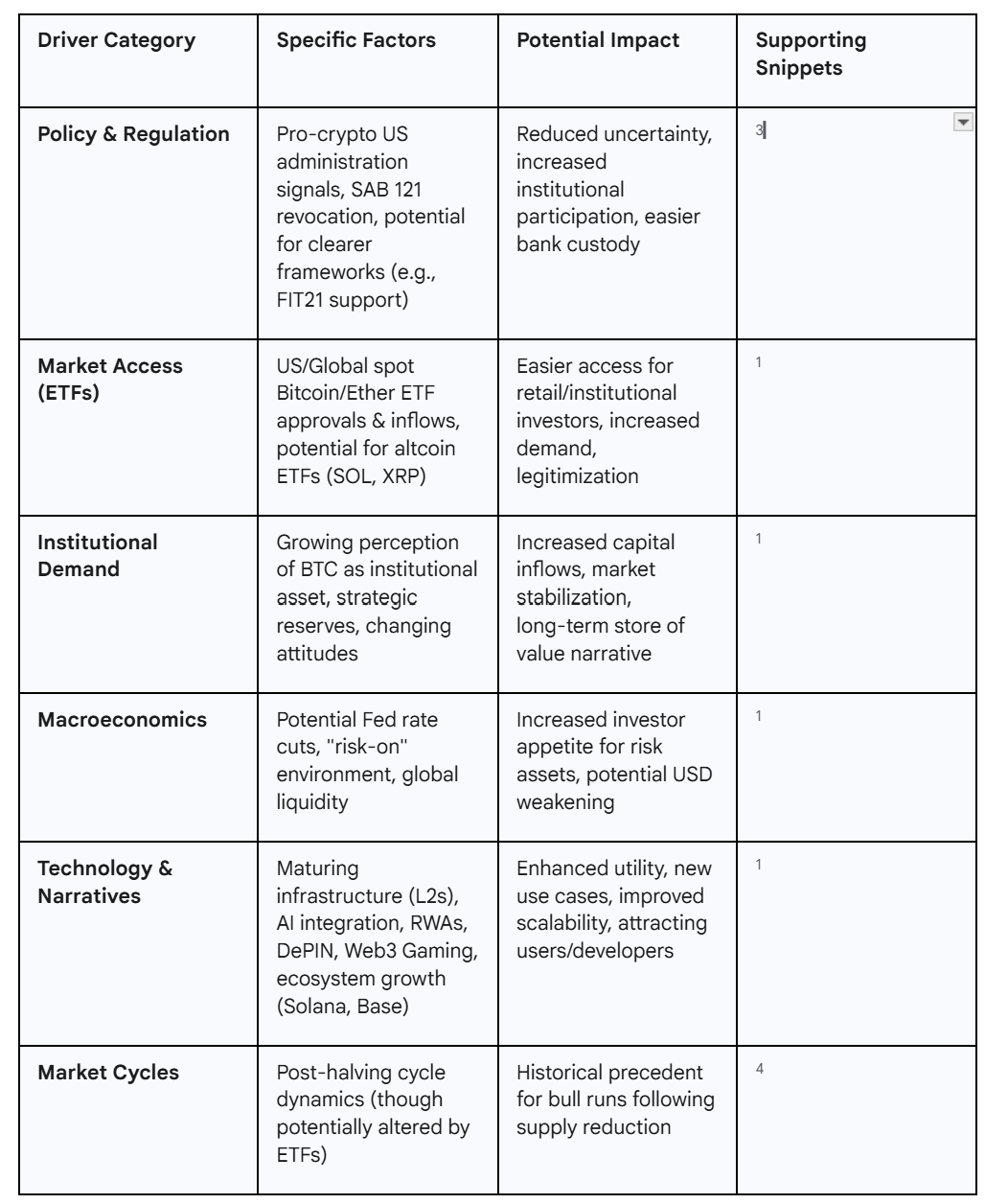

Key Drivers of the 2025 Crypto Bull Market

Several interconnected factors are contributing to the optimistic outlook for the cryptocurrency market in 2025. These range from macroeconomic tailwinds and increasing institutional participation to specific technological narratives gaining traction.

Macroeconomic Conditions and Policy Shifts

The broader economic environment appears increasingly favorable for risk assets like cryptocurrencies. Anticipated interest rate cuts by the Federal Reserve and other major central banks in 2025 could inject liquidity into the market and encourage investors to seek higher returns in assets perceived as riskier.1 An environment where investors are more willing to take on risk generally benefits cryptocurrencies, which tend to be influenced significantly by macro conditions.3

Furthermore, significant policy shifts, particularly in the United States, are bolstering market sentiment. The election of President Donald Trump signaled a move towards more crypto-friendly policies, including a stated desire for a strategic Bitcoin reserve and the appointment of supportive policymakers to key regulatory bodies like the SEC and CFTC.3 This marks a potential departure from the previous administration's more cautious, sometimes described as hostile, "regulation by enforcement" approach.3 A key development was the revocation of the SEC's Staff Accounting Bulletin 121 (SAB 121), which had previously imposed strict balance sheet requirements on institutions custodying digital assets, effectively limiting participation by major banks.3 Its removal opens the door for more established financial institutions to offer custody solutions, potentially broadening the investor base.3 This evolving regulatory posture, coupled with broader bipartisan support for pro-crypto legislation like the (previously opposed) FIT21 bill, is expected to foster greater investor confidence and adoption.3 President Trump's signing of an executive order on March 6, 2025, establishing a U.S. Strategic Bitcoin Reserve further underscored this shift.4

Institutional Adoption and Market Access via ETFs

Perhaps the most significant catalyst has been the growing ease of access for institutional and retail investors through regulated financial products. The launch of spot Bitcoin ETFs in the US in January 2024, followed by approvals in other jurisdictions like Hong Kong, marked a pivotal moment.2 These products provide a familiar and regulated on-ramp for investors, leading to substantial capital inflows – US spot Bitcoin ETPs attracted $34.6 billion in net flows by the end of 2024 and held over $101.8 billion in assets.3 Bitcoin's surge past $100,000 in early 2025 was directly attributed to this unprecedented ETF demand.1

The success of Bitcoin ETFs has paved the way for similar products for other major cryptocurrencies. Spot Ethereum ETFs were approved later in 2024, and filings indicate potential ETFs for altcoins like Solana and XRP are under consideration.1 As more cryptocurrencies become accessible through ETPs to a wider investor base globally, prices are anticipated to benefit.3 This institutional validation is also changing perceptions of Bitcoin, increasingly positioning it as an institutional-grade asset and a potential long-term store of value, drawing comparisons to gold ETFs.2 While early 2025 saw some ETF outflows, potentially signaling short-term institutional profit-taking or caution, renewed inflows are expected to reignite bullish momentum.4

Maturing Infrastructure and Emerging Narratives

Beyond institutional flows, the underlying technology and ecosystem are maturing. Significant advancements in crypto infrastructure, including Layer 2 scaling solutions, are making blockchain networks more efficient and capable of handling increased demand.1 Practical use cases are emerging beyond speculation, spanning areas like decentralized finance (DeFi), real-world asset (RWA) tokenization, and decentralized physical infrastructure networks (DePIN).1

Several key narratives are expected to drive growth in 2025 1:

Artificial Intelligence (AI) & Blockchain: Integration promises enhanced trading, fraud detection, and decentralized AI tools.

Real-World Assets (RWAs): Tokenizing tangible assets like real estate or bonds to improve liquidity and accessibility.

Decentralized Physical Infrastructure Networks (DePIN): Using blockchain to build decentralized networks for services like energy or data storage.

Layer 2 Scaling Solutions: Technologies like Optimism, Arbitrum, and Polygon addressing scalability, reducing fees, and enabling wider adoption.

Specific Ecosystem Growth: Ecosystems like Solana (known for speed and low fees) and Base (Coinbase's L2) are attracting developers and users for DeFi, NFTs, and gaming.1

Web3 Gaming: Blockchain integration allows players true ownership of in-game assets, fostering new economic models.

Liquid Restaking Tokens: Innovations in DeFi offering enhanced yield opportunities on staked assets.

Memecoins: While highly speculative, they continue to attract retail interest and drive engagement, particularly on high-throughput chains.1

Market Indicators and Price Predictions

As of mid-April 2025, the total crypto market capitalization stood around $2.55 trillion, recovering slightly but still navigating resistance levels.1 Bitcoin traded around $81,000-$83,000, down from its all-time high above $109,000 achieved in late 2024/early 2025 but significantly up from previous lows.1 On-chain indicators and sentiment metrics like the Fear & Greed Index presented mixed signals, reflecting typical market consolidation and profit-taking after sharp rallies.4

Despite short-term uncertainty, many analysts remain bullish for the remainder of 2025. Price targets for Bitcoin range from $150,000 to as high as $250,000 by year-end, citing the combined impact of ETF inflows, institutional demand, potential rate cuts, and the historical precedent of post-halving cycles (though the 2024 halving's impact may be altered by the new institutional dynamics).1 A breakout above key technical resistance levels (like the $2.82 trillion total market cap) could confirm a macro reversal and ignite the next leg of the bull run, potentially pushing the market towards the $3.3 trillion–$3.5 trillion range in Q2 2025.1 There is also anticipation of a broader "Altcoin Season" later in the year, where capital may rotate from Bitcoin into other promising cryptocurrencies.1

Conclusion

The cryptocurrency market in 2025 appears poised at a potentially pivotal juncture. While historical cycles and technical indicators offer some guidance, the landscape is fundamentally reshaped by the surge in institutional interest, facilitated by accessible ETF products, and a potentially more favorable regulatory environment in key jurisdictions like the US. Combined with supportive macroeconomic conditions and continued innovation within the crypto ecosystem across diverse narratives like AI, RWAs, and Layer 2 scaling, the arguments for a continued bull run are compelling. However, investors must remain cognizant of the inherent volatility, the potential for regulatory shifts, and the influence of macroeconomic factors. The interplay between these drivers will ultimately determine whether 2025 solidifies its place as a landmark year for digital asset adoption and price appreciation.

Works Cited

CoinDCX. "Is the Next Crypto Bull Run Coming Soon in 2025?" CoinDCX Blog, 11 Apr. 2025, coindcx.com/blog/cryptocurrency/crypto-bull-run-coming-soon-in-2025/. Accessed [Date of Access]. 1

Compass Mining Education. "Bitcoin Bull or Bear Cycle Analysis: Where Are We in March 2025?" Compass Mining, education.compassmining.io/education/bitcoin-bull-or-bear-cycle-analysis-where-are-we-in-march-2025/. Accessed [Date of Access]. 4

Invesco. "Digital Assets: Is the Bitcoin Bull Run Just Getting Started?" Invesco US, 14 Feb. 2025, www.invesco.com/content/invesco/us/en/insights/digital-assets-bitcoin-bull-run-just-getting-started.html. Accessed [Date of Access]. 3

Media OutReach Newswire. "Bitcoin and Beyond: Navigating the 2025 Crypto Bull Run with Global Broker Octa." Viet Nam News, 12 Feb. 2025, vietnamnews.vn/media-outreach/1692048/bitcoin-and-beyond-navigating-the-2025-crypto-bull-run-with-global-broker-octa.html. Accessed [Date of Access]. 2

Nasdaq. "First Mover: Wells Fargo Bitcoin Briefing Could Signal Bull Run Intact." Nasdaq, 8 Dec. 2020, www.nasdaq.com/articles/first-mover%3A-wells-fargo-bitcoin-briefing-could-signal-bull-run-intact-2020-12-08. Accessed [Date of Access]. 7

User on Binance Square. Post ID 19767417948113. Binance Square, 2 Mar. 2025, www.binance.com/en/square/post/19767417948113. Accessed [Date of Access]. 5